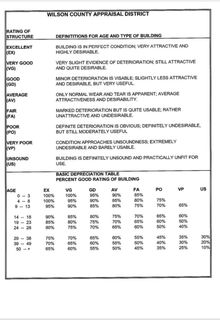

CLASSIFICATION CODES AND IMPROVEMENT CODES:

PDF

PDF

(Contributed by Alena Berlanga)

This information was obtained through an records request with Wilson County Appraisal District for the codes so taxpayers can better understand how to read the evidence package and comparables.

- Double check WCAD's “math” and codes for your property.

- Be sure the classification for each structure on your property is in the right category. Example: If you have a structure that is classified as a metal building, but it’s actually just a metal roof and open sides (like a carport), your price per square foot will be different and your overall appraised value will be different.

- Compare their square footage for each structure to what it actually is. If your square footage is less than the CAD data, your value will be different.

- Check to see if all the structures listed on your evidence package are actually yours. There have been instances where one property had a structure on their property according to CAD, however, it was the neighbors structure that was mistakenly added to their appraisal.

- Confirm that any changes to your structures (i.e. demolished, repurposed shed to chicken coop, etc.) are reflected in your evidence package

The more you know, the better prepared you will be for your hearing.